By Michael Kaminsky, Co-Founder, Recast

Marketing and finance teams often speak different languages: while one values creative risk and long-term growth, the other demands measurable ROI and reliable forecasts. This disconnect is especially painful given marketing’s paradox: it’s often the largest budget line item and at the same time, the hardest to accurately measure.

This paradox leads to consequences across the entire organization.

Finance can’t validate marketing investments or generate forecasts with confidence, and marketing can’t prove impact beyond vanity metrics. And, as trust erodes between teams, both sides retreat to their corners, often frustrated and still misaligned.

However, incrementality testing seeks to bridge this divide. It gives marketers a means of proving what truly drives incremental outcomes while arming finance with better forecasting and confidence in their capital allocation.

But why is this new approach necessary? And how can it be leveraged to deliver tangible financial results?

Flipping the Measurement Script

Often, finance teams rely on platform-reported metrics or tools like Google Analytics that “match” purchases to ad interactions, creating an illusion of precision. They layer in tracking metrics like impressions, clicks, and reach data, building their analyses on increasingly shaky foundations.

These metrics often overcount actual business results, and when finance plugs inflated numbers into their cash flow models and scales spend, forecasts consistently miss the mark.

A vicious cycle ensues. Missed targets lead to slashed budgets, pushing marketers to double down on “easy-to-measure” channels like brand search or retargeting that capture existing demand instead of driving incremental growth. Then, performance declines further, trust erodes, and the organization slips into a marketing-led death spiral.

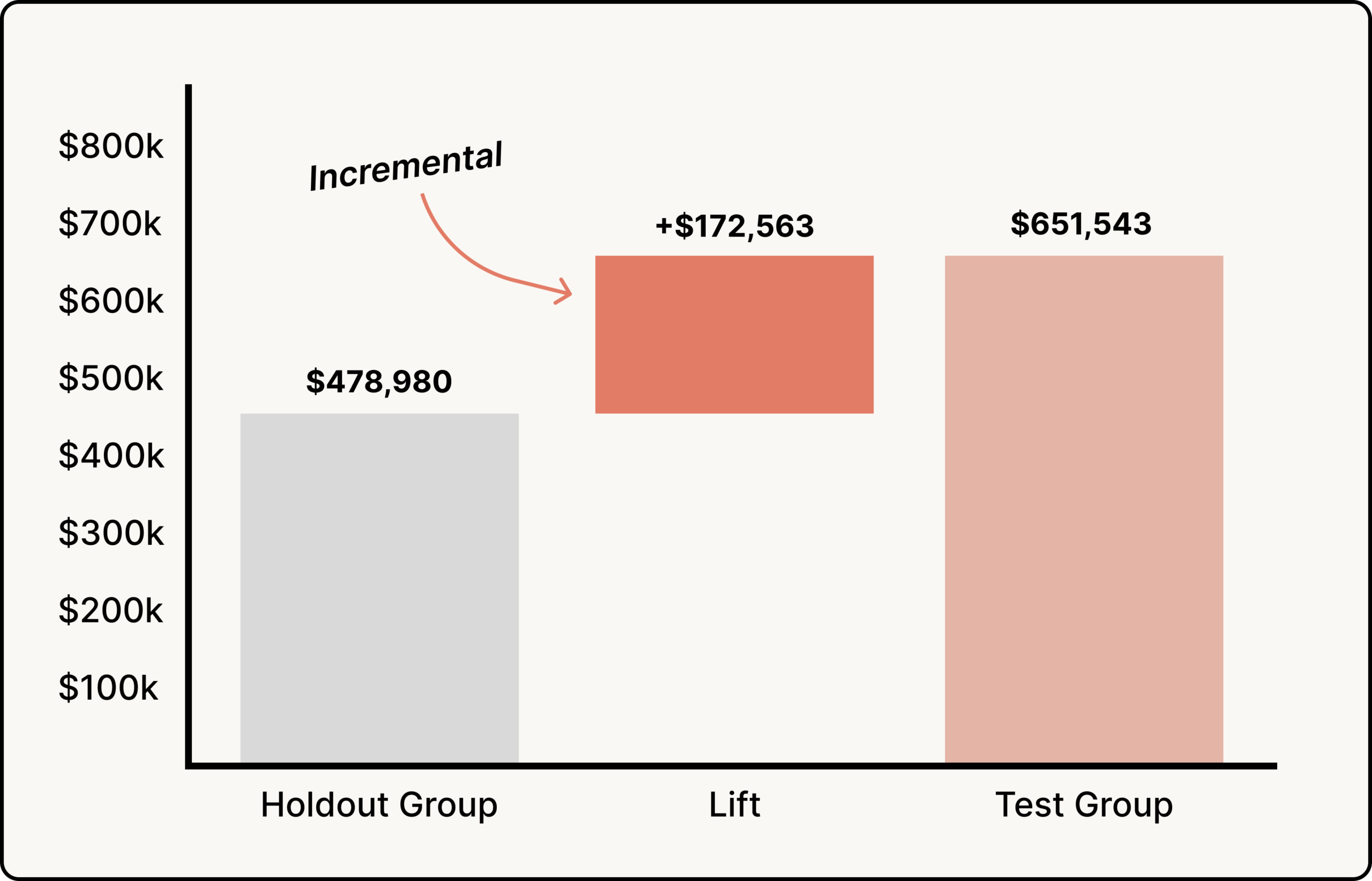

Incrementality tests break this cycle with one powerful shift: it measures what marketing actually causes, not what it claims credit for.

Instead of:

Facebook reports a 3.7x ROI, a point estimate that counts customers who would have purchased anyway,

You get:

We estimate Facebook’s incremental ROI is between 3.2x – 4.5x, a range of estimates for the sales Facebook actually caused.

This truth – even with its uncertainty – transforms everything.

Finance can finally forecast accurately. Marketing can defend budgets with causal evidence. The death spiral stops because both teams are working with the same reality.

This approach uses the same logic as clinical trials in healthcare, employing structured experiments with control groups to estimate causal relationships between interventions and outcomes. In the context of marketing, it measures the causal relationship between advertising spend and business outcomes like revenue, leads, or app sign-ups.

The key insight is that incrementality tests measure what wouldn’t have happened without a specific marketing intervention. They answer finance’s fundamental question: “If we spend an additional dollar here, what incremental return do we get?”

This focus on causal relationships rather than correlations is what separates incrementality testing from traditional marketing metrics.

Creating Connective Tissue Between Marketing and Finance

How do you actually begin building the lift testing bridge between marketing and finance? There are a few critical steps to take today:

- Start with joint education sessions where both teams align on incrementality vocabulary and establish shared success metrics focused on profitable growth rather than vanity metrics.

- Reframe incrementality testing as strategic “measurement investments” that improve decision-making. This helps finance view lift tests as essential infrastructure for better capital allocation.

- Start testing with your most debated or uncertain channels to prove immediate value. When incrementality testing resolves longstanding disagreements about channel performance, both teams see its worth.

- Establish a regular testing cadence – quarterly for major channels, less frequent for smaller ones – with transparent communication about what can and can’t be measured (including long-term brand effects).

Building this connective tissue between marketing and finance isn’t easy, but steps like these will help ensure you start on common ground.

Further Tips: Using Incrementality Tests for Financial Planning

With this foundation in place, you can begin incorporating incrementality experiments into actual financial forecasts – and see real improvements in planning accuracy.

Consider implementing these tactics:

- Incorporate Uncertainty: Build forecasting templates with high, medium, and low scenarios based on reported confidence intervals. True incrementality is unknowable – your models should reflect this.

- Ignore “Statistical Significance”: Focus on uncertainty ranges instead. For planning, we recommend using the bottom half of confidence intervals for conservative estimates that build credibility.

- Navigate Unmeasured Channels: Assume performance at the low end of measured channels. Document assumptions explicitly and accept that some effects can’t be measured precisely.

- Validate Continuously: Compare forecasts to actual results monthly. This feedback loop improves both testing methodology and planning accuracy.

Forging a New Marketing-Finance Partnership

Incrementality testing won’t eliminate tension between marketing’s brand-building ambitions and finance’s need for predictability. But it provides something more valuable: a shared language for discussing risk and return.

Organizations that master this collaboration gain sustainable competitive advantages by allocating budget based on causal evidence rather than correlation. They forecast with confidence intervals instead of false precision.

The bridge between marketing and finance isn’t built on a false sense of certainty, but on honest, measurable uncertainty that both teams can plan around.