By Paul Neto, co-founder and CMO, Measure Protocol

The world of digital marketing and advertising has always been fast moving, perhaps nowhere more so than in the world of social media apps. Take, for instance, the news that Twitter is to increase character limit from 280 to 4,000, as part of a wider overhaul of its interface in the face of overwhelming negative press.

And then there’s TikTok – not long ago the new kid on the block. According to an article in the FT, this hugely popular app is now undercutting rivals with cheap ads, with advertisers and brands claiming that much spend is moving from Meta, YouTube and Twitter.

TikTok has shaken up the social media industry in recent years. Having rapidly grown to more than 1bn users worldwide, it has led rivals to launch their own short-form video offerings such as YouTube’s Shorts and Instagram’s Reels. Its meteoric rise serves to illustrate how it can feel almost impossible to keep up with the latest developments.

So, in order to keep abreast of some of the ways in which consumers are using social media apps – where they are spending their time and what they are doing – we dove into granular, behavioral data to uncover the key trends using data collected through our proprietary Retro solution. The resulting App Life Report shows that in the U.S., on average, individuals use 42 apps and spend about 44 hours on their iPhones weekly.

It’s clear that analysis of behaviors within these apps can bring to life consumers’ entertainment, lifestyle, media and purchasing habits. Below are a couple of examples of the data we were able to uncover – the full report includes information on streaming services, gaming app engagement and much more.

TikTok: The stickiest app?

While recent stats show that TikTok has been downloaded 3.5 billion times, there’s much more to the story. People aren’t just downloading the app and then not using it (a common story with some other apps).

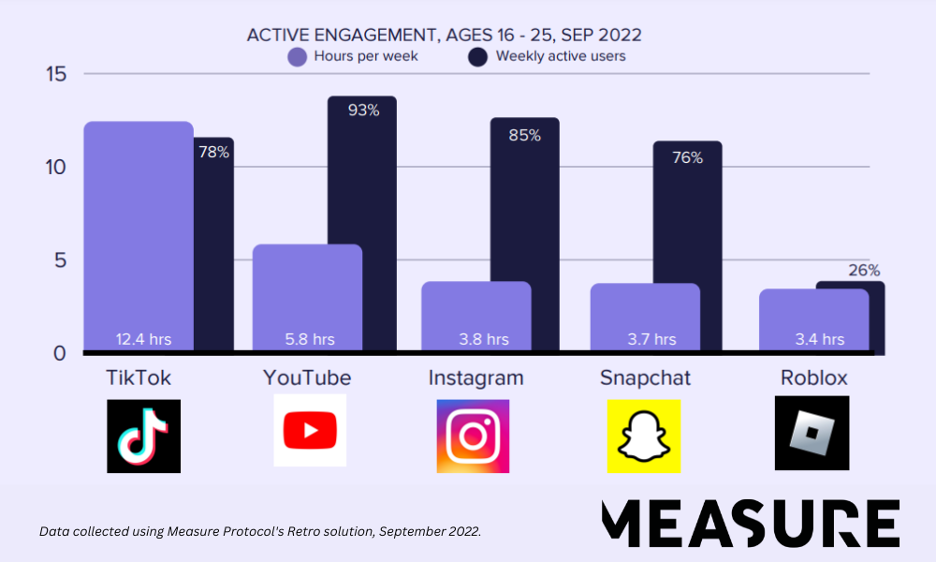

On average, we found that respondents are spending 12.4 hours per week on TikTok, with YouTube as the runner up at 5.8 hours per week and Instagram in third place. Over 24% of individuals have TikTok ranked as their top-used app, 10% have it ranked as their second most used, and only 5% ranked as their third most used app. In contrast, YouTube was ranked as the most used app for only 13% of individuals. Just under 12% have Facebook as their most used, and 6.8% have Instagram ranked as their most used. So, it’s clear that this platform is filling ‘micro gaps’ in the day with 15-second-or-shorter memes, dance videos, magic tricks and funny videos.

Clearly, TikTok is a force to be reckoned with – something which has caught many marketers off guard. Despite long-held controversy around its security, with data harvesting and spying on users at the forefront of privacy debates, users don’t seem to mind as they continue to flock to the app for all types of content. As countries consider banning the app due to overwhelming security concerns, its sheer popularity and usage numbers make the idea of eliminating it seem farfetched. Yet there is no doubt that advertisers and marketers would do well to come up with strategies that include reaching consumers on this highly favored app, especially if younger audiences are a target.

Apple, Amazon and SHEIN lead the way with purchases

During the month of September 2022, the most commonly used shopping App by iOS users aged 16-25 was Apple’s App Store at 91%, followed by Amazon at 77%. Meanwhile, SHEIN continues to establish itself with nearly 28% of individuals ages 16-25 using it weekly. What’s more, according to the Wall Street Journal, the company is exploring selling more than its own brand apparel and creating a platform that will “enable merchants to sell directly to consumers.” With its rising popularity, this type of business model change can eat into market share of existing legacy players.

By looking at exactly how individuals are spending time on their phones and interacting with apps, advertisers can start to make headway and come up with strategies to have a significant presence in people’s daily. For example, with simple download and review data, there would be no way to know which competitive apps were stealing away customers’ time – thus, where to direct advertising budgets. In the shopping world, this kind of data is critical in securing consumer spend.

Looking beyond downloads to behavioral data

Only one thing is certain: advertisers need to understand how people are using specific apps, or they will be left behind. Digging into in-app behaviors can generate huge reservoirs of insights into what people are watching and how they are engaging with various content types, trends, influencers, hashtags, genres and more. By seeing what they ‘like’, where they comment and how they are spending time on their mobile devices, it is possible to build a holistic picture of customers and potential customers, to help you identify trends, predict future behaviors, and make well informed decisions. It’s time to redefine engagement beyond rudimentary metrics. Marketers and advertisers must consider factors such as active engagement and notifications to gain new perspectives, in order to turbocharge competitor analysis and keep track in real-time.

So don’t get caught up with vanity metrics alone: Look beyond superficial data and dig into app usage and behavioral data and trends which can help paint a clear picture of where people are spending their time, what they are doing, and what they are buying. This can inform advertising spend, growth marketing strategy and product development; keeping you well ahead of the pack.

About the Author

Paul Neto, co-founder and CMO of Measure Protocol, is a pragmatic technologist and a market researcher, with a rich and varied career history in research technology, data analytics and advertising effectiveness measurement. He co-founded Measure to solve the challenges he saw in the digital data collection space, developing innovative technologies and fundamentals that offer new opportunities for data and analytics. He believes that by changing the fundamental principles of data collection, with better access to valuable behavioral data, both brands and individuals can benefit