By Jason Fairchild, CEO of tvScientific

By the time somebody searches for a product or service and clicks through an ad, that person’s intent is already firmly established. Google became Google by selling advertising on its famous search engine. By structuring the business around click-throughs and conversions stemming from searches, it leveraged its market dominance to build the sprawling giant we know today.

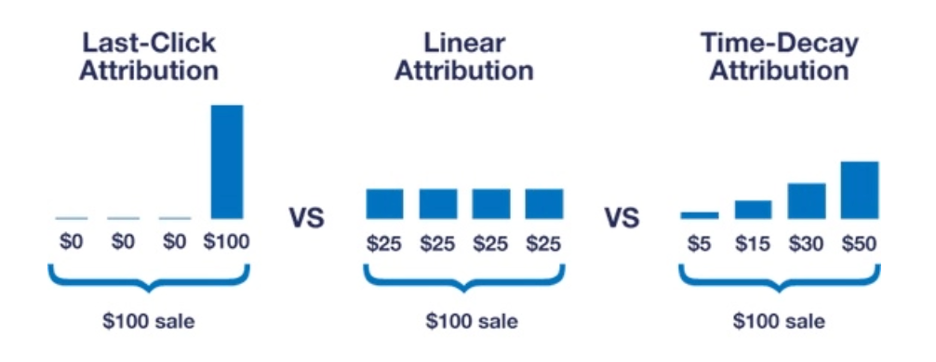

In doing so, Google took advantage of a path-to-purchase dynamic that’s easy to overlook: Whether their search is branded or categorical, consumers are already far along in their consideration toward a purchase when they search for something on Google. They have already shown that they care about answers and information enough to initiate their query. Google has thus, historically, claimed all of the credit and revenue flowing from that last mile of consumer attention. This is analogous to buying from Amazon and assigning all marketing credit to FedEx for delivering the package to our front door. Yet because this process is readily quantifiable through “last click attribution,” dollars have flowed into Google’s coffers.

While there is no denying the economy-changing tool that is paid search, modern measurement methods suggest Google’s or more specifically search marketing outsized position in the overall ad performance story for marketers in today’s omnichannel environment, over-indexing on search advertising is like overpaying the top goal-scorer on a soccer team: Sure, the top goal-scorer often enjoys a salary premium, but they wouldn’t be scoring goals if other essential players weren’t moving the ball up the field.

The problem with the current primacy of search campaigns in the digital ecosystem is that they occlude the importance of other channels on the path to purchase. Display ads, for example, can elicit a direct response (a click-through and/or purchase) that’s also easy to quantify and transact against, although display doesn’t show ROI as directly and thus receives less money and attention. Other channels, like TV, receive even less credit than they deserve.

Connected TV (CTV) advertising, in particular, is becoming increasingly popular as more consumers leave traditional broadcast platforms like cable and move their viewership to streaming services. CTV ads bring addressability advantages which enable marketers to craft more personalized and targeted advertisements at a lower unit cost than traditional TV commercials.

Connected TV (CTV) advertising, in particular, is becoming increasingly popular as more consumers leave traditional broadcast platforms like cable and move their viewership to streaming services. CTV ads bring addressability advantages which enable marketers to craft more personalized and targeted advertisements at a lower unit cost than traditional TV commercials.

The technology and know-how now exist to measure CTV, the fastest-growing video channel, to accurately quantify its effect on real business KPIs like captured leads, subscriptions, or sales. The process for evaluating performance against a control group is not a new technology, in fact the industry standard test-control methodology will celebrate its centennial in 2024, it is the rise of connected platforms and digital media delivery that has unlocked measurement at scale. While traditional TV platforms are still working to shift buying and ad placement motions to support addressability, CTV has entered the space and has the added bonus of being built from the ground up with addressability and measurement in mind.

One of the benefits of personalized advertising is that it’s more engaging than traditional broadcast format commercials. Viewers are more likely to pay attention to an ad if it’s relevant to them, and one of CTV’s primary advantages over TV is that CTV ads can be targeted to specific demographics or interests. With the right marketing message and audience strategy, this can lead to higher engagement rates and, ultimately, higher returns on ad spend.

Search is disproportionately taking credit for last-click conversions, and a change is coming. While search advertising has historically received much attention and resources, it’s important not to overlook the role that other channels play in the path to purchase. Display ads, social media campaigns, and CTV commercials can all influence a customer’s decision-making process.

As technology advances, it’s becoming easier to measure CTV ads, allowing advertisers to more accurately understand the true impact of their campaigns – also known as the “halo effect.” This ability will be essential in a changing technology landscape where other methods of proving ROI (like third-party tracking cookies) are going away. And in the current economic climate, every ad dollar will need to stretch further. It’s time for marketers to reconsider the role of CTV in their overall media mix.