By Susie Vowinkel, Industry Director, TravelGoogle

With the holiday season fast approaching, travelers are making choices we haven’t seen before. But that’s no cause for despair. While new COVID-19 variants inevitably affect consumer priorities, understanding how today’s travelers navigate the new normal can help you position your brand for success this holiday season. Here are the travel insights you need to know.

Craft a message for the cautious

Travel is rebounding after a brutal year and a half for the industry. Thirty-six percent of people around the globe are now participating in some sort of travel activity.1 Moreover, travelers say they feel safer, with the perceived risk of taking a vacation down by 17% since January 2021.2

On average, 45% of travelers said they planned to travel within their own countries in the early fall, and 8% planned to travel internationally.3 When it comes to holiday travel, 30% to 40% will plan trips a month or more in advance, while the majority will make plans less than a month ahead of time.4

With so much subject to change right now, it’s no surprise that travelers want the flexibility to cancel or postpone trips. The New York Times reports that some luxury travelers are even “trip stacking,” or buying two trips for the same period in case one falls through due to unforeseen restrictions. In both the U.S. and EMEA, booking and cancellation flexibility ranks as the second most important factor influencing consumer holiday travel decisions, right behind price, deals, and discounts.5

More marketers put “insights delivered from trusted partners” above “having an increased marketing budget.”

Health concerns are also top of mind for today’s travelers. In APAC, health and safety procedures beat price, deals, and discounts as the most important factor influencing holiday travel. In the U.S., health and safety procedures tie with flexibility and availability for second place.6

Fortunately, the industry is listening: The top areas of investment for travel companies in 2021 are revised health and safety measures and contactless experiences.7 But while 85% of U.S. travel marketers say that offering flexible bookings and cancellations will be important this year, 38% say their businesses are not fully set up to provide flexible purchasing options.8 Making flexibility a priority for the holidays will be an important step toward meeting rising demand and new expectations as travelers return to the roads, rails, and skies.

Understand new needs

With travel finally seeing gains around the world, murmurs of “vaccine passports” have been gaining steam. Globally, 78% of adults agree that COVID-19 vaccine passports should be required of travelers to enter their country, raising the question of whether the industry is ready to meet the increase in consumer demand.

Sixty-seven percent of travel marketers expect their marketing budgets to increase moderately to substantially during the remainder of 2021.9 Yet 88% recognize that some areas of their businesses aren’t yet ready to deliver for customers this year, and 73% report that they are generally challenged to meet traveler needs.10

So how should a travel marketer get ready for the holidays? When asked what would help them drive greater success through the end of the year, more marketers put “insights delivered from trusted partners” above “having an increased marketing budget.”11 With that in mind, we isolated a few holiday travel trends to help marketers prepare.

Travelers are sticking close to home

As COVID-19 cases rise, fall, and rise again, it’s no small feat to understand travel restrictions, rules, and exemptions as they change. And it’s hardly surprising that most travelers are planning domestic trips instead of international travel for the holidays.12

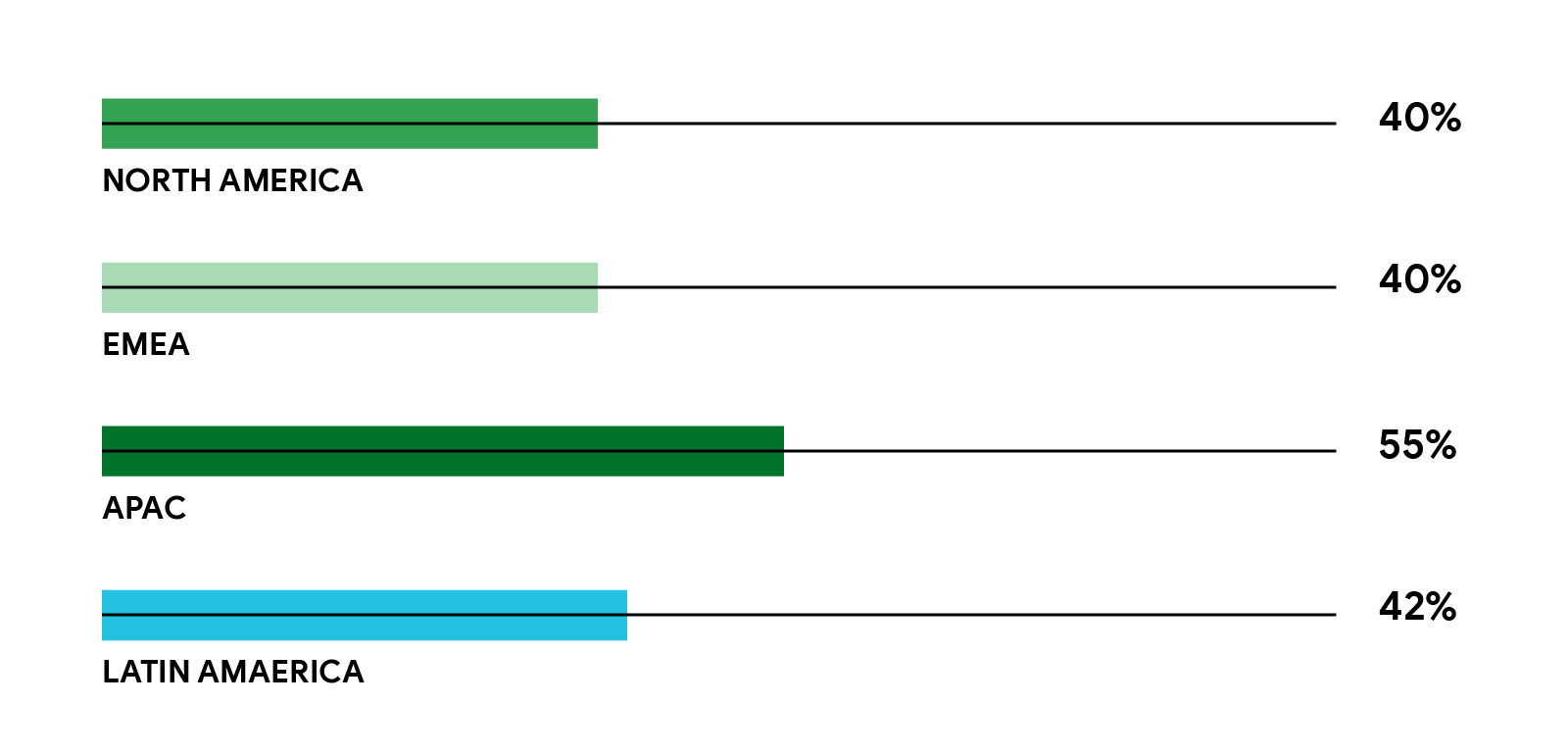

Holiday travelers planning to stay within their own countries

Of those expecting to travel within the next three months, 55% plan to travel outside of their state or province but within their own country, and 53% plan to travel within their state or province.13

As marketers look to make the most of domestic travel, 50% expect travelers to prioritize socially distanced options during the remainder of 2021.14 In turn, the travel industry will need to prioritize sanitation, masking, social-distancing protocols, and crowd minimization to meet the expectations of holiday travelers.

Travel will be meaningful

Consumers are looking to make the most of their travel experiences, both in terms of why they are traveling and with whom. Visiting friends and family is the top reason to travel this holiday season, with the majority of travelers going to see their loved ones.

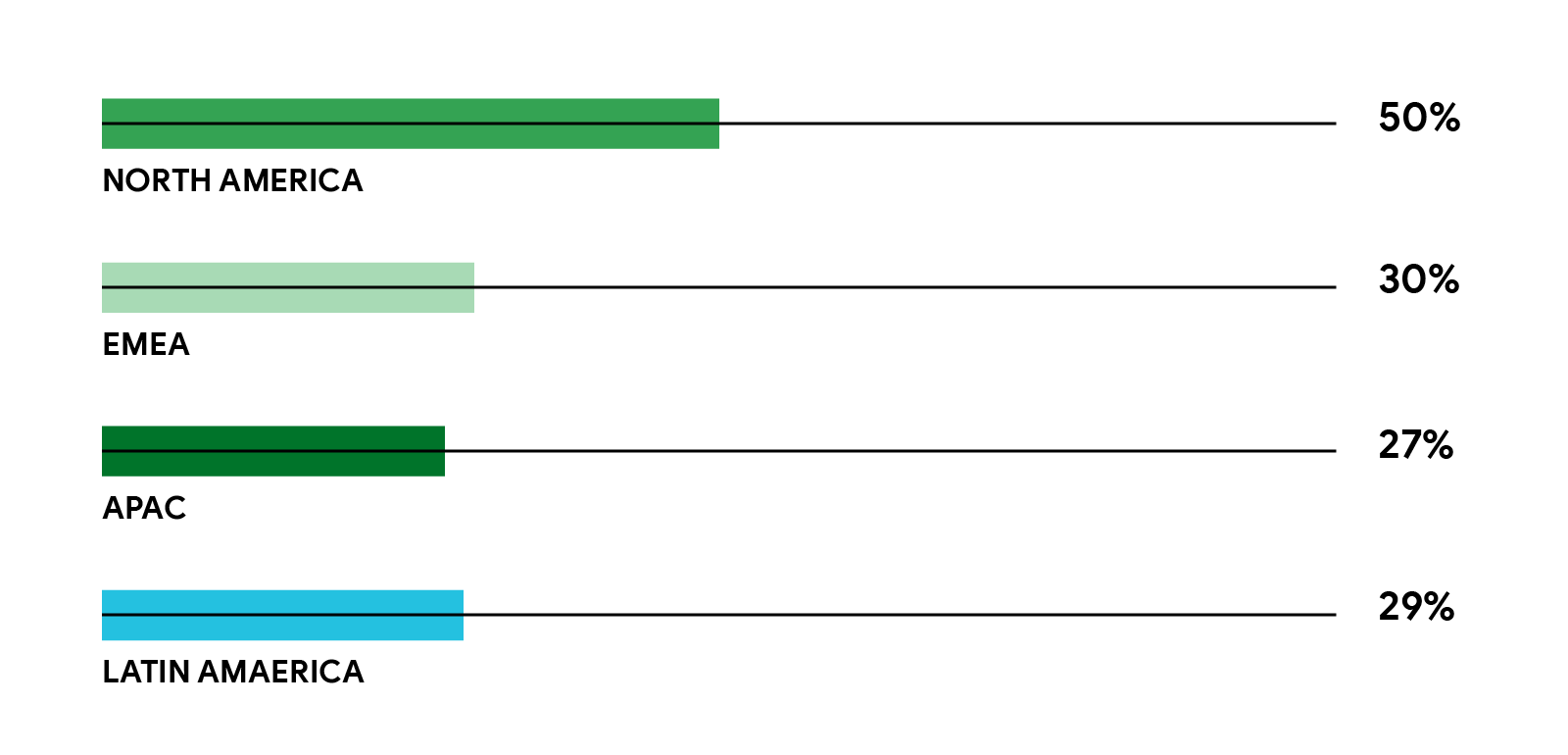

Holiday travelers planning to visit family and friends

Many travelers are also seeking sustainable travel options, prioritizing their values as they plan trips. In fact, according to Booking.com’s 2021 Sustainable Travel Report, 72% of travelers think that travel companies should offer sustainable travel choices.

We recently announced how we are working to highlight sustainable options within our travel tools, as well as our partnership with Travalyst. At the same time, 42% of U.S. travel marketers say their companies are not set up to offer sustainable or eco-friendly solutions in 2021, making it the leading area of business for which they are unprepared.15 For those companies that are ready to deliver, eco-conscious options are a unique selling point worth highlighting to potential travelers, alongside family-friendly experiences.

Personally, I’ll be prioritizing travel to visit and spend time with family this holiday season. And I’m far from the only one. People are eager to start exploring again, priming the industry for a comeback. While many marketers feel unprepared to meet the surge in demand, these insights show a focus on safe, flexible, and meaningful domestic options can help meet customer expectations.

This perspective originally appeared on Think With Google

Sources (5)

1, 2, 3, 13 Ipsos, Global, Essentials Report, survey conducted on the Global Advisor online platform, 14,500 adults aged 18–74 in CA and U.S. and aged 16–74 in AU, BR, CN, FR, DE, IN, IT, JP, MX, RU, ZA, KR, ES, and U.K., n=11,523, Aug. 26, 2021–Aug. 29, 2021.

4, 6 Google-commissioned Ipsos COVID-19 Tracker, AU, BR, CA, CN, FR, DE, IN, IT, JP, MX, RU, ZA, KR, ES, U.S., and U.K. ~n=400–1300 online consumers 18+ per region that plan to travel for the holidays, Sept. 9, 2021–Sept. 12, 2021.

7, 9 Google/Savanta, The Future of Travel: The Travel Marketer Perspective 2021, online survey, n=502 male/n=477 female travel/tourism manager and marketing decision-makers/influencers fully employed by mid- to large-market companies, March 2021–April 2021.

10, 11, 14, 15 Google/Savanta, The Future of Travel: The Travel Marketer Perspective 2021, online survey, n=983 travel/tourism manager and marketing decision-makers/influencers fully employed by mid- to large-market companies, March 2021–April 2021.

12 Google-commissioned Ipsos COVID-19 Tracker, AU, BR, CA, CN, FR, DE, IN, IT, JP, MX, RU, ZA, KR, ES, U.S., and U.K. ~n=500–1000 online consumers 18+ per market, Sept. 9, 2021–Sept. 12, 2021.