And 7 Things Marketers Need to Know about the Exploding Hispanic Population

Welcome to the new multicultural America. With the recent release of 2020 U.S. Census data, it’s clear that former “minority” groups in the United States are quickly gaining ground on the traditional majority white population, which started shrinking more than a decade ago. And one population segment in particular is skyrocketing: Hispanic American consumers, which number over 63.6 million and are the fastest-growing U.S. population segment today.

Claritas’ newest report, The 2021 Hispanic Market Report, predicts that the U.S. Hispanic population will account for 67% of total U.S. population growth in the next five years. And the spending power of Hispanic consumers – which totaled $1.9 trillion in 2020 – is also expected to continue to grow, exceeding more than $2 trillion by the end of 2021.

Marketers looking to target younger age groups should be particularly interested in the Hispanic market, as Hispanic consumers today make up 23.5% of the U.S. Millennial population – which means that nearly one out of every four Millennials is now Hispanic. And by 2026, 27.2% of the American population under age 30 will be Hispanic.

If you’re a marketer looking to build campaigns specifically designed to tap into the $2 trillion in Hispanic spending power, here are some good things to know:

- U.S. Hispanics use traditional banking services less than other populations but are more likely to use online payment services such as Apple and Google Pay. In fact, Hispanic Americans are 46% more likely than non-Hispanic Americans to have no bank account – but Hispanic adults are 26% more likely than average to use Apple Pay and 22% more likely to use Google Pay.

- 99% of Hispanic Americans use a wireless cell phone, with 81% receiving a bill and 19% using prepay services. S. Hispanics also prefer Apple and Samsung phones and are 27% more likely to say they will switch wireless providers in the next 12 months.

- Not only are Hispanics willing to switch wireless carriers, they also like to shop around for insurance. According to Claritas research, 24% of U.S. households that shopped on the Internet for health insurance in the past 6 months were Hispanic. Hispanic consumers were also more likely to have shopped for auto insurance – with 12% shopping around versus only 8% of non-Hispanics.

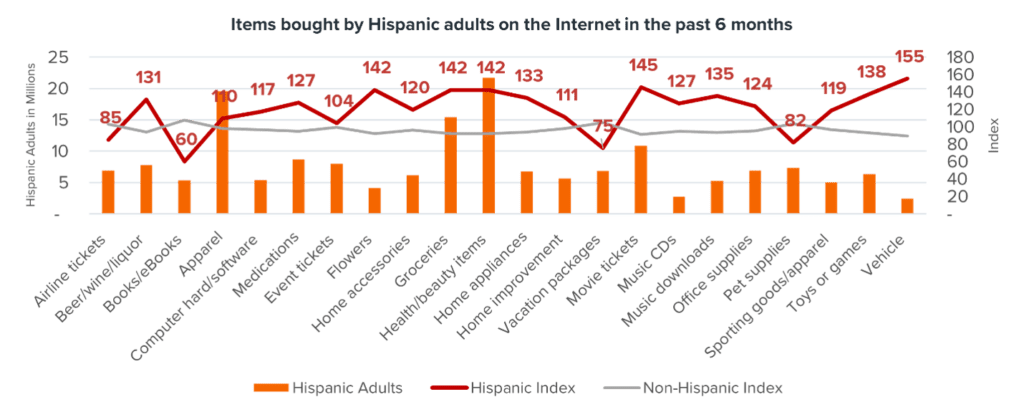

- In the next five years, U.S. Hispanic consumers will be big buyers of both clothing and auto products and services. According to Claritas research, in the next five years, U.S. Hispanics will account for an estimated 34% of the growth in retail apparel purchases, with spending reaching an estimated $49 billion by 2026. And an estimated 66% of the spending growth in auto parts, equipment and accessories will come from Hispanic households in the next five years.

- 58% of Hispanics have already cut the cable cord – and they also tend to be big streamers. According to Claritas research, Hispanics are 34% more likely than average to watch live TV on their cell phones, with Netflix and Amazon Prime being popular streaming options.

- To catch the attention of Hispanic consumers on social media or the Internet, try Instagram and Snapchat; bargain shopping sites such as CraigsList and Groupon; or search sites such as Yahoo!. When examining Internet site usage in a 30-day period, Claritas found that 33% of Hispanics visited Instagram compared to 21% of Hispanics, and 25% of Hispanics visited Snapchat versus 13% of non-Hispanics. In addition 23% of Hispanics visited CraigsList compared to 16% of non-Hispanics and 21% visited Groupon compared to 13% of non-Hispanics.

- Each Hispanic population segments is very unique – and must be targeted accordingly. Case in point: 1 out of 3 of Hispanic Americans are Spanish language dependent or bi-lingual Spanish preferred.

While insights into the larger Hispanic population are helpful, even more value comes from understanding how exactly to appeal to specific segments within the Hispanic population. Claritas helps leading marketers – both large and small – do just that.

While insights into the larger Hispanic population are helpful, even more value comes from understanding how exactly to appeal to specific segments within the Hispanic population. Claritas helps leading marketers – both large and small – do just that.

Thanks to Claritas, one food producer increased sales of a product that it believed would appeal to the U.S. Hispanic and Asian communities by 300% – in just one year. The company used Claritas data to identify different multicultural segments. It then delivered a targeted retail campaign that optimized inventory and marketing based on the specific multicultural consumer segments that shopped at each store.

And shoe and apparel retailer Andrea USA leveraged the Claritas CultureCode® HISPANICITY™ segmentation tool to attract Hispanic sales agents. The resulting social media and email campaign generated a 25.3% email click-through rate and a 1,100% increase in conversions.

The bottom line is this: Any company marketing to U.S. consumers would be ill-advised to ignore the growing multicultural population in the United States. With its exploding population, growing spending power and youthful bent, the U.S. Hispanic population segment represents a lucrative opportunity for savvy marketers – both today and in the near future.

To request a copy of the newest report in Claritas’ series of multicultural reports called “The New American Mainstream” – visit The 2021 Hispanic Market Report on Claritas